Quest for the Stock Market Holy Grail

Stock Market, ETF, Mutual Fund Investing strategies to make money in the real world

Teach children about investing

The greatest power that you have as a parent is the ability to teach them about money while generating personal wealth for your kids that can last a lifetime.

The greatest power that you have as a parent is the ability to teach them about money while generating personal wealth for your kids that can last a lifetime.On your child's first birthday skip out on all the presents while doing something for them that will allow them to retire rich and happy later in their life. Invest 1,000 (or more) for their retirement and teach them the power of money compounding early. Simply use the one step investment strategy to allow it to grow while protecting your downside. The reason you should invest 1,000 dollars is because you can make them rich beyond their wildest dreams when they are older through the power of compounding in the stock market.

When your kids turn 12

On your child's 12th birthday time to break out the latest statement and teach them all about compounding. Once they see that 1,000 of their own money has compounded to 5,350 they will be investors for life. Be sure to include the projected amount his stock trading account will be at by 18, somewhere in the ballpark of 12,375! Talk about a easy way to get kids interested in investing and making money in the stock market.

When your kids turn 18

On your child's 18th birthday it's time to teach them about the power of a retirement account. Sit down again with them and teach them all about the employee match from their employer will most likely be able to contribute in. They already know how powerful compound interest can be, now they will find out that someone else will give them "free money" for the retirement they will be so exited, they might actually pee their pants! Another way to get kids exited about compounding interest more fun, make a deal with them to match their employers amount with your own money.

Retirement

If everything goes right you will have made your kids money grow from 1,000 to compound to a fantastic 8,817,787. Now talk about starting out retirement with a bang! What's even better is if they actually start putting some of their own money into their companies retirement plan, then that number would be bigger.

Money is not

Everything, that's right I said it, money is not everything, but it does help. Just remember to give your children lots of love and teach them as much about things as you can, all they really want is for you to spend time with them. Make sure to also teach them what you did for them with the 1,000 dollars and maybe when they are older teach them to do it with closer to 10,000 just to keep passing the wealth down through future generations.

ETF Strategy to make money

One Step ETF Strategy

One Step ETF StrategySome ask how can I make money with an ETF Strategy that will protect me from stock market losses while still making me money? Many think the answer to diversify with bonds, however there is a better way. I am going to show you how to build a one step ETF Strategy that can protect you from big losses and make you money year after year. This method has been fully backtested and proven over the last 25 years.

ETF Background

According to Morningstar only 15% of mutual funds beat the S&P 500 year after year. With this much bad performance it's no wonder that ETF's have entered the picture. Since ETF's are ran by computers the expenses are very low compared to the high cost of mutual funds. The other benefit is you don't have to worry about an ETF having a short term lack of judgment because their manager is having a bad day.

ETF Strategy Solution

The goal was to find a properly diversified mix of equities that yielded around the same annual rate of growth without sacrificing loosing annual gain each year through exposure to bonds. We have found that the proper allocation of:

ETF Strategy Solution Allocation

40% S&P 500

40% REITs

20% Small-Cap Value

The results was a fantastic 13.9% compounded annual gain. This result was not even what made us so exited, the Maximum drawdown over the last 25 years was only 11%. If you compare the maximum drawdown during that period to these drawdowns you will be amazed.

Index Drawdowns

S&P Drawdown: 45%

Russel 2000 Value Index Drawdown: 33%

Russel 2000 Growth Index Drawdown: 63%

Russel 1000 Value Index Drawdown: 28%

Russel 1000 Growth Index Drawdown: 63%

ETF Strategy can reduce your risk like the professional money managers.

Since the S&P 500 Compounded annual gain was only 13.4 we are gaining 1/2 a percent gain while reducing our risk by 4 times. This means that you can beat the S&P 500 while limiting your risk and you will know that your protected against large losses of money.

When did the ETF Strategy Solution loose money?

There was only 4 years that you lost money:

1987: 0.6% loss (not bad considering there was a major crash)

1990: 5.4% loss

1994: 0.2% loss

2002: 4.1% loss (this is when most investors lost 40% of their money)

Sounds great, what ETF's should I buy?

REIT selection: ICF

S&P 500 selection: SPY

Small Cap Value selection: IWN

These etf's were chosen because of their transaction costs were very low compared to others as well as performing slightly better during down markets than their peers.

This ETF model can and will make you money while reducing your risk. So get out there and let ETFs work for you. Remember to let your money work for you, not you for your money!

Easy Money in the Stock Market with StockScouter

During 2000 - 2002 investors were loosing their shirts. Many people were loosing their whole retirement accounts. The pain of loosing this much money is more than most people can take. You may be one of those people but I hope not.

During 2000 - 2002 investors were loosing their shirts. Many people were loosing their whole retirement accounts. The pain of loosing this much money is more than most people can take. You may be one of those people but I hope not.So I am going to show you an easy strategy that a beginner can make money in the stock market year after year to the tune of 48%. The best part is that this strategy is free, you won't need any fancy computer systems or expensive stock market timing software.

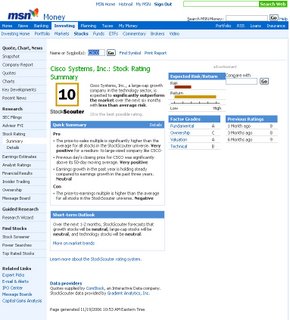

One question that beginners ask is how can I find a stock that will make me money when there are over 7500 to choose from? Our answer to this is StockScouter from MSN Money. StockScouter is not perfect but it will give you the information needed to make money year after year without knowing much.

StockScouter is a Quantitative research tool that does the hard work of finding out if you should buy a stock. StockScouter will rate each stock from 1 to 10 (10 is the best). Each day the stocks get recalculated with a new score.

Here is how they do that:

Fundamental - It checks the company's past growth earnings, estimated future growth and it's ability to beat the analysis projections. It must be growing fast enough to be powerful in the future.

Ownership - It checks to see if the company owns its own stock. To have a high score, a stock must be owned by high ranking executives or board members.

Valuation - It finds out if the stocks price is high or low based on its level of sales, earnings and growth.

Technical - The stock should have a positive technical signs of growth to get a high score.

Generally StockScouter will do well in a 6 month or under time frame. Reason being is that after 6 months there are too many factors that can change the stocks price. So now lets get into how we are going to make some money in the stock market. We are going to take the top 10 picks in the StockScouter index. These are stocks that are very strong currently and in powerful sectors that are very hot right now. This list changes every Tuesday.

- We are going to start with 10,000 and put 1,000 in each stock. You are going to set your stoploss levels at 20% for each stock to protect your money. This way if your stock looses money you will loose no more than 2% of your total money. This strategy uses best money management rules.

- We are going to rebalance our portfolio of 10 stocks on Tuesday. Visit MSN Money on Tuesday and get your list of stocks to buy. Now buy them!

- Now we are going to give our stocks 1 week before we come back to the StockScouter top 10 list. Now compare the list to your list of stocks you own. If any stocks are no longer on the list, Sell it and take any loss or gain you might have. The rule is to hold your stock as long as it's on this list.

Our research indicates that should receive close to a 48% return on your money per year. Keep it simple, why try and complicate things. I would say give it 3 months and see how you like this strategy. Maybe use a play money account to track the results.

Our research indicates that should receive close to a 48% return on your money per year. Keep it simple, why try and complicate things. I would say give it 3 months and see how you like this strategy. Maybe use a play money account to track the results.So how did your 10,000 do over a 5 year period?

Starting Money: $10,000.00

Ending Money: $504,216.62 !

Not bad for easy to follow free research, Can you Digs it?

Stratasearch Review Discovery Software

I spent a full 30 days reviewing StrataSearch (they have a free trial) , the Automated Strategy Discovery Software and here is what I found.

Stratasearch does a good job on backtesting strategies and optimizing your current strategy. Stratasearch is lightning quick at scans and handles thousands of combinations quite nicely.

They have what is called a OneClick strategy detection. You tell it what types of things you want out of your system such as Low Drawdown, High Winning Percentage or maybe a Holding time under 7 days. Once you have your goals setup, you are on to the scanning part. This part takes a full day, maybe 2, if you ask me this is a long time to let your computer scan. But trust me once you get the results you will be happy. What it's doing is automatic trying to add lots of stock entry's and stock exits together to find the best combo. I found that I had my best result after about 2 days of letting it scan.

Now that you have your entry and exit setup try to optimize it a little more to squeeze every ounce of money making power out of it. This is what I like to call the Stratasearch crack, it will crack your strategy wide open and unlock your true systems potential. Stratasearch if used right will explode a torrent of cash.

Just like any other Technical Stock Trading software, Stratasearch will take some time to learn how it works. Compared to Wealthlab Developer I would say it's a piece of cake. I found that the staff of stratasearch was very helpful while I was learning the language.

I recommend that you give it a 30 day trial and see if you like it

You will not find your Holy Grail of stock systems, but you will have a decent chance to enhance your system that was missing the "right" thing.

Stock Market Indicator Charts

Many new traders spend coutnless hours trying to find the magic combo of Stock Market Indicators on charts. But can you really find the holy grail using this method? The anger is yes and no, let me explain how:

Market Indicators will show you things that the naked eye can't see on charts. They allow you to confirm market moves such as moving average crossovers, ADX, RSI, MACD and many more. Is there a magic formula for mixing them together with different data time frames?

No. There is no magic formula you can use with these indicators to mix and match your way to endless riches. I personally have tested hundreds of thousands of combos with a program from StrataSearch without success. But don't give up, and I'll explain why you should continue your quest for YOUR stock market holy grail trading system.

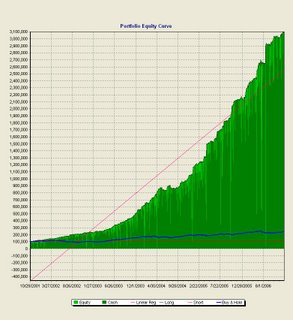

If you use a few technical indicators with strict money management rules, it is possible to be the stock market year after year. What proof do I have that this will work? Well check out the screenshots of my trading system:

This system in a 5 year period would take 100,000 dollars to 3,100,000. How about that for some results. This system compounded by the tune of 98% annually. Well this is fine and all, but look at the Drawdown:

This system in a 5 year period would take 100,000 dollars to 3,100,000. How about that for some results. This system compounded by the tune of 98% annually. Well this is fine and all, but look at the Drawdown:

Notice how the maximum drawdown is less then 10% so why is this so important. Because for each 10% you are down, you need to make 11% to make you 10 back. This is why using risk to manage your money is the most powerful part of the system.

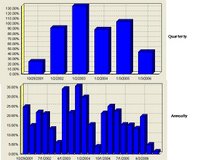

But how did it to during this 5 year period? You can see the results of Quarterly and Yearly. There was not 1 year down or Quarter. So during this tough markets of 2000-2003 when the S&P 500 lost 60% of their money, this system was making money hand over fist.

This system actually does BETTER during a bull market, so that is the scary part. So please don't give up on your system and feel free to contact me for advice on how to improve your system.

Make more money in Stocks

I think the best way people can plan and make more money in stocks is to understand money and numbers better. A large part of trading stocks comes down to how well do you manage you money. After that, the only way to make more money is to work longer hours, but who in their right mind wants to do that right? The best and easiest way to make more money is to spend less money while you are learning the art of trading stocks

I think the best way people can plan and make more money in stocks is to understand money and numbers better. A large part of trading stocks comes down to how well do you manage you money. After that, the only way to make more money is to work longer hours, but who in their right mind wants to do that right? The best and easiest way to make more money is to spend less money while you are learning the art of trading stocksYou do take on some risk with stocks, as all stocks go up and down. With your new found money management skills you will be in control enough to limit your risk. I only advise taking on trades with a 3 to 1 risk to reward ratio. With stocks you can get a 10% to 15% return on your investment without even thinking. If you want to get higher returns you will have to work for it. There are lots of people including myself that are getting 30% or more for the last 10 years. As with stocks, profits and losses are realized daily, so you can loose a lot quick and make a lot even faster with better money management rules in place.

The one thing to remember is that it's not very hard to get started.

Short Term Trading in Volatile Markets

Short term trading is ideal for volatile and nervous markets. The good thing about short term trading is that drawdowns can be limited in time as the equity curve responds more quickly to short term moves. Short term trading is not by definition less risky, however the rewards are good if you can master it. Short term trading is defined as 1 week to 3 months. Short term trading is not an amateur's game and is usually not a road to quick riches, but hang in there, you will get it.

Short term trading is ideal for volatile and nervous markets. The good thing about short term trading is that drawdowns can be limited in time as the equity curve responds more quickly to short term moves. Short term trading is not by definition less risky, however the rewards are good if you can master it. Short term trading is defined as 1 week to 3 months. Short term trading is not an amateur's game and is usually not a road to quick riches, but hang in there, you will get it.As Ed Seykota says "People always get what they want out of the markets. If you want to win, you will. However if you want to loose, you will."

Short term trading is inherently win or lose.

Stock Market Bubbles before the Crash

A stock market crash is defined by a sudden, unexpected, and abrupt drop in stock prices.

A stock market crash is defined by a sudden, unexpected, and abrupt drop in stock prices.The 1987 stock market crash is one example in which people lost a lot of money. Very little is known about this subject, but the 1987 stock market crash is a perfect example of a market error.

So are the wizards of Wall Street worried that another 1929 stock market crash is on the horizon? The true cause of a stock market crash is economic instability.

Because the decline was so dramatic during these crashes, this event is often referred to as the Great Crash of 1929 and 1987.

Is the biggest real estate bubble in history about to burst? When that bubble burst in 2000, that included about 50 percent of Americans.

A stock market crash is not a traumatic event. It is a simple correction from a bubble of simple supply and demand. This is another great lesson why it would be best to stay diversified.

Control your Maximum equity drawdown

Maximum equity drawdown is used to measure the maximum equity loss.

Maximum equity drawdown is used to measure the maximum equity loss.Bottom line is that this is just simple risk control planning to avoid equity loss. You can use your computer simulation to maximize profits and control risk on your trading system.

You can even combine these systems with with money management algorithms. Using proper money management will give your system an edge.

People trade with more money than they should. Taking on too much risk. So try and keep your investments to 10% of your TOTAL equity and never loose more than 2% of you total equity. This will give you some wiggle room if the stocks price declines. Once you are beyond that 2% range you need to get out right away.

Remember, Bulls make money, bears make money, pigs get slaughtered.

History Stock Market Data for backtesting

How do you know which stock market data is pertinent? One way is to use a well known data service like Prophet

How do you know which stock market data is pertinent? One way is to use a well known data service like ProphetStock Market History The history of the stock market is both fascinating and full of useful information for building a trading system.

Provide more timely stock market research and stock market data so that informed clients make better trading decisions. This leads to higher gains for them.

By backtesting you can be sure that your trading system works over time. New backtesting rules will help you find optimum strategies. Backtesting Results will not predict the future, however it will give you a good idea if your trading system will work.

Typically stock market data is presented as Open, High, Low, Close and Volume. Be sure that your stock data comes in this format.

Stock Market Research for trading

Stock market research is a vital part of investing and trading within the stock market. Perhaps the most important flaw in stock market research is the mechanical treatment of time without regards to valuations.

Stock market research is a vital part of investing and trading within the stock market. Perhaps the most important flaw in stock market research is the mechanical treatment of time without regards to valuations.Technical analysis, chart patterns, and real time stock market research designed to make buying and trading stocks easy and affordable.

Fundamental analysis is based upon the traditional study of supply and demand factors that cause prices to rise or fall.

Using money management is a must if you want to achieve your trading goals. Trading Goals, Do You Have Them? One should ask themself that before entering any trade.

Get started in the stock market with strategy

A popular stock market strategy is to buy an index tracker which automatically follows the performance of an index. Another way is to get started with a trending system is simple and easy.

A popular stock market strategy is to buy an index tracker which automatically follows the performance of an index. Another way is to get started with a trending system is simple and easy.Just be sure to keep it simple and avoid getting burried in technical indicators such as RSI, ADX and thousands more.

Work on your first system and call it a Bullish 50/200-day MA Crossovers system. Then head on over to StockCharts.com and use their StockScan tool to find stocks for the following day. Find it here

Next you need to work on your money management rules.

Hedge Fund Risky Investments

An investment in a Hedge Fund is not suitable or desirable for all investors. Finding the right hedge fund is like finding a good pair of shoes. More than with most other fund investments, a hedge fund is a reflection of the investment style and strategies of the fund manager.

An investment in a Hedge Fund is not suitable or desirable for all investors. Finding the right hedge fund is like finding a good pair of shoes. More than with most other fund investments, a hedge fund is a reflection of the investment style and strategies of the fund manager.Most people view hedge funds as risky investment vehicles. No guarantees, you understand; this is a very risky investment.

The typical fee for a hedge fund is 2% of assets annually plus 20% of any gains.

GDP Review Jim Cramer’s Real Money: Sane Investing in an Insane World

I found Jim Cramer’s Real Money: Sane Investing in an Insane World an exelent book for a new look on Fundamental Style Investing. GDP cycle from Jim’s no hold bared investing aproach will improve your current trading strategy. There is lots of truth in this book. One thing I found interesting is a chart he keeps on his desk to show the GDP cycle and what types of stocks tend to do good based on the economic cycle. Well worth the read!

Make money with stock market investments

Get a real idea of what the stock market is like, and how much money you can make with stock investments. The bottom of the market starts at a time when the stock market is weak and the general population is pessimistic. The stock market is doing well, will we have less cash advance stores now.

Get a real idea of what the stock market is like, and how much money you can make with stock investments. The bottom of the market starts at a time when the stock market is weak and the general population is pessimistic. The stock market is doing well, will we have less cash advance stores now.Today’s financial news from around the world; Current world stock market report. Not surprisingly, active traders have a strong interest in financial news.

A 5% gain turns into a 10% gain if you use some of that extra trading money. Day Trading Money Management.

There’s no such thing as the Perfect Investment. But the search for a –˜perfect investment’ is elusive and usually ends in disappointment.

The stock market is a strange fellow: It has multiple personalities. The stock market is never appropriate as a short-term investment.

Quest for the System Trading Holy Grail

First, because the quest for the Holy Grail is, mostly, Utopian. As I said, however, Holy Blood, Holy Grail is fascinating. But Holy Grail is educational too. The Holy Grail is now permanently out of reach. One man’s holy grail is another man’s piece of junk.

First, because the quest for the Holy Grail is, mostly, Utopian. As I said, however, Holy Blood, Holy Grail is fascinating. But Holy Grail is educational too. The Holy Grail is now permanently out of reach. One man’s holy grail is another man’s piece of junk.The major advantage for many traders is the time system trading takes. Consequently, I advocate system trading for most people. Find Out How To Succeed In Online Trading With System Trading. We believe in system trading.

TurtleTrader trend following system

Michael is the main person behind turtletrader. Michael Covel of the trend following web-site, turtletrader.

Michael is the main person behind turtletrader. Michael Covel of the trend following web-site, turtletrader.There is a new book on the market titled Trend Following by Michael Covel. Trendchannel Trend Following with the Trendchannel Futures Trading System. Trend Following Trading, Original Turtle Trading System and Donchian Trading.

Richard Donchian trend following moving average system

Richard Donchian is considered the father of trend following.

Richard Donchian is considered the father of trend following.He published his 5-20 moving average system and his trading guidelines. Donchian Channels: A moving average indicator developed by Richard Donchian. Donchian channels, percentage bands, and moving average envelopes.

He was considered a pioneer in the managed futures. Richards methods are used by mutual funds even today. Like many traders, he got his taste of the bug by reading Reminiscences of a Stock Operator by Jesse Livermore.

Years later Richard became the approach known as trend following. By using this system and his weekly rule system based on moving averages. Many systems follow his methods such as the turtle trading system. When he died in 1993 the Richard Donchian foundation was established to help other traders achieve higher levels of personal success in the stock market. We will really miss Richard.